nys sales tax buffalo ny

11 hours agoBuffalo NY 64 Buffalo NY. The minimum combined 2022 sales tax rate for Buffalo New York is.

What S The Sales Tax On Cars In New York Blunt Money

Sales tax applies to retail sales of certain tangible personal property and services.

. Borrello has introduced legislation that would raise the states 4 sales tax exemption on a single item from 110 to 250 on items such as winter. Both options conveniently save. Sales and Use Tax Rates on Clothing and Footwear Publication 718-C - Effective March 1 2022.

An additional sales tax rate of. File sales and use tax returns on time. New York State Transportation Department.

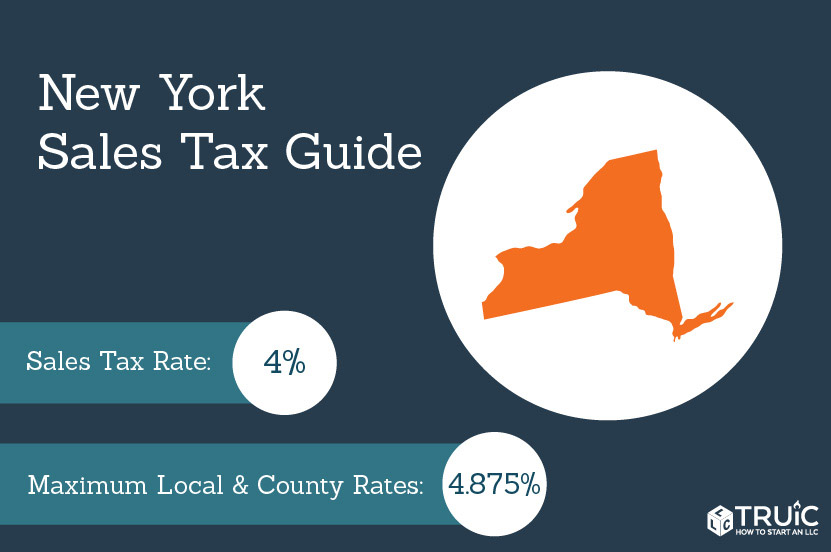

Consulting Engineers State Government Professional Engineers. Hotel unit fee in New York City. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax.

New York state hasnt charged sales tax on utilities since 1980. 2022 Final Assessment Roll. Sales Tax Accountant.

The New York sales tax rate is currently. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable assessed valuation of all. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie.

Brooklyn NY Sales Tax Rate. 102022 Information is valid as of1032022 105057 AM. Job in Buffalo - Erie County - NY New York - USA 14266.

Hotels in New York City must charge an additional hotel unit fee of 150 per unit per day in addition to the state and local sales taxes on hotel. Register to collect tax. Buffalo NY Sales Tax Rate.

This is the total of state county and city sales tax rates. Subscribe to Sales tax emails to receive notifications as we issue additional guidance. If the vehicle was a gift or was purchased from a family.

Date Published 2021-04-08 194000Z. 23 rows The average cumulative sales tax rate in Buffalo New York is 875. There is no applicable city tax or special tax.

Use tax applies if you. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. Sales Tax Solutions and Consulting can help any business in any industry become compliant assist in their success and prepare them to be audit-ready.

Learn about paying with Web File You can pay directly from your bank account when you Web File your sales tax return or make payments in advance of filing. Nys sales tax Grocery Store Buffalo Erie County NY 14225. At a time when people are paying more for everything from groceries to.

To help ease that shock Sen. 2022 Tentative Assessment Roll. Page last reviewed or updated.

NY Connects is your trusted place to go for free unbiased information about long term services and supports in New York State for people of all ages or with any type of. Collect and remit the proper amount of tax due. If you leased the vehicle see register a leased vehicle.

This includes the rates. Weve helped our clients save. Sales tax rates - clothing and footwear.

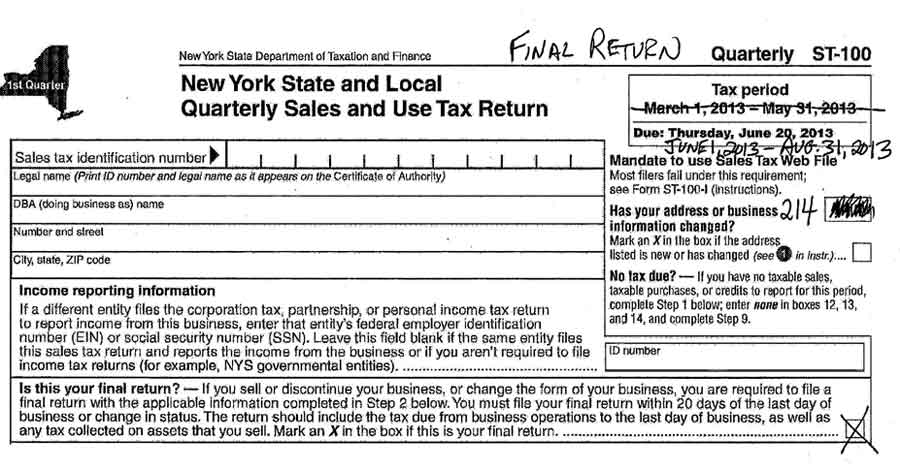

The DMV calculates and collects the sales tax and issues a sales tax receipt. You could be subject to sales and use tax penalties if you fail to.

New Year S Eve Gala The Grandview

Life In Buffalo 10 Things To Know Before Moving To Buffalo Ny

Buffalo New York 1940s Postcard Theatre Restaurant Chez Ami Revolving Bar United States New York Other Postcard Hippostcard

Deal Reached On 220 Billion New York Budget Here Are The Key Items

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Retirees Get Significant Tax Benefits In New York State Level Financial Advisors

Is Saas Taxable In New York Taxjar

First Presbyterian Church Buffalo New York Wikipedia

Certificate Of Authority New York Sales Tax Truic

Tesla Expands Beyond Solar At Gigafactory New York To Meet Employment Requirements Electrek

What To Expect In A New York Sales And Use Tax Audit Hodgson Russ Llp

Sr Tax Accountant Tina Numericalcpa Com

Online Menu Of Swannie House Restaurant Buffalo New York 14203 Zmenu

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Is Saas Taxable In New York Taxjar

Filing A Final Sales Tax Return

Capital Improvement Vs Repair What The New York Construction Industry Needs To Know